Bank Secrecy Act Beneficial Ownership Rule

Beneficial Ownership Requirements for Legal Entity Customers Overview Objective. Beneficial ownership refers to the person s with ultimate control over funds in the account whether through ownership or other means.

Https Www Clearygottlieb Com Media Files Alert Memos 2020 Congress Overhauls Aml Framework Mandating Disclosure Of Beneficial Ownership Information Pdf

Under the Beneficial Ownership Rule 1.

Bank secrecy act beneficial ownership rule. Effective May 11 2018 new rules under the Bank Secrecy Act will aid the government in the fight against crimes to evade financial measures designed to combat terrorism and other national security threats. The CDD Rule clarifies and strengthens customer due diligence requirements for US. Beneficial Ownership is a new rule from the Financial Crimes Enforcement Network FinCEN under the Bank Secrecy Act which requires all covered financial institutions to collect and verify from certain non-exempt legal entities specific information about the beneficial owners of the entity at the time a new account is opened.

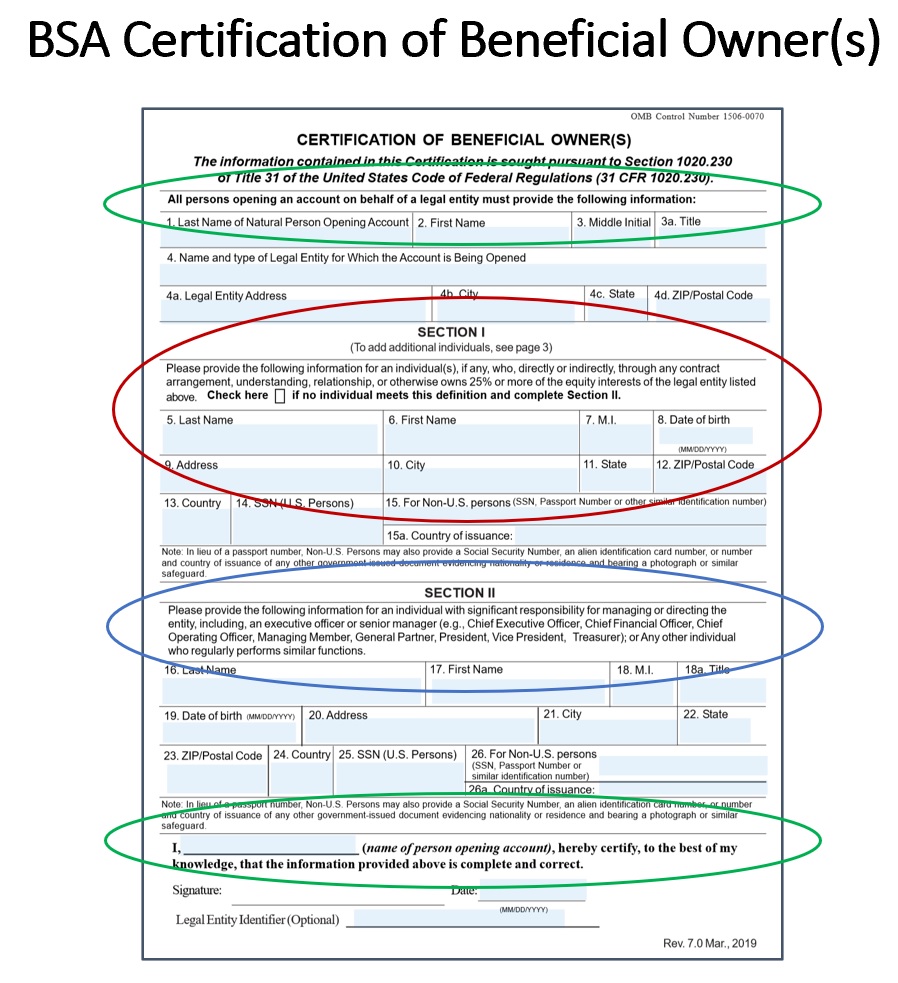

At the time of implementation of the Beneficial Ownership Rule the Patriot Act already required that banks collect certain information of parties opening bank accounts. Beneficial Ownership is a requirement from the Financial Crimes Enforcement Network FinCEN under the Bank Secrecy Act which mandates all covered financial institutions collect and verify from certain non-exempt legal entities specific information about the beneficial owners of the entity at the time a new account is opened. Each time an account is opened for a covered.

What is the Beneficial Ownership Rule. In issuing its final rule on beneficial ownership the Financial Crimes Enforcement Network FinCEN exempted charities and nonprofit entities from the ownership prong of the requirement but not the control prong. Beneficial Ownership Requirement.

Banks mutual funds brokers or dealers in securities futures commission merchants and introducing brokers in commodities. Assess the banks written procedures and overall compliance with regulatory requirements for identifying and verifying beneficial owners of legal entity customers. Going forward banks must identify a legal entitys ownership and control for new accounts including.

The Financial Crimes Enforcement Network today published a long-expected set of frequently asked questions on expanded customer due diligence requirements under the Bank Secrecy Act including a new requirement for banks to identify and verify legal entities beneficial owners when accounts are opened. FinCENs Beneficial Ownership Rule Communication guides and templates staff analysis and training to help you comply with the Beneficial Ownership Rule. The CDD Rule which amends Bank Secrecy Act regulations aims to improve financial transparency and prevent criminals and terrorists from misusing companies to disguise their illicit activities and launder their ill-gotten gains.

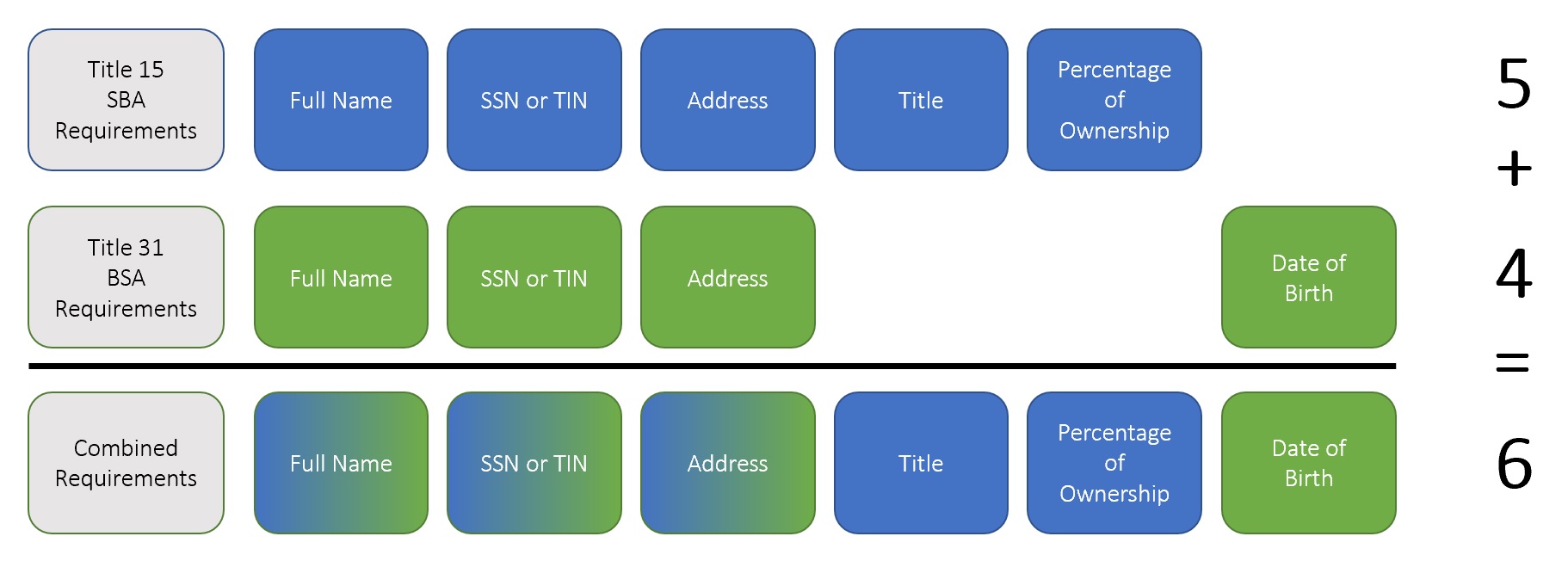

The Beneficial Ownership regulation requires covered financial institutions to establish and maintain written procedures that are reasonably designed to identify and verify beneficial owners of legal entity customers. Beneficial Ownership is a new rule from the Financial Crimes Enforcement Network FinCEN under the Bank Secrecy Act which requires all covered financial institutions to collect and verify from certain non-exempt legal entities specific information about the beneficial owners at the time a new account is opened. Specifically pursuant to Section 326 of the Patriot Act banks must obtain the following Customer Identification Program CIP information from customers and reasonably verify such information15.

Bank Secrecy Act Featured Resources. The intent of the Beneficial Ownership Rule is to assist authorities in counteracting money laundering tax evasion and other financial crimes. A bank must establish and maintain written procedures.

The rule designates ownership and control as being two different types of beneficial ownership. The rule Customer Due Diligence Requirements for Financial Institutions 81 FR 29398 May 11 2016 which became effective July 11 2016 creates explicit customer due diligence. The new requirement referred to as a new fifth pillar of the Bank Secrecy Act BSA mandates that banks expand their policies programs and processes for identifying customers to include beneficial owners of legal entity ownerships such as limited liability corporations and partnerships.

Federal Register Customer Due Diligence Requirements For Financial Institutions Correction

Fincen New Cdd Rule What Is The Fifth Pillar Capital Compliance Experts

Cdd Rule Beware Of Events That May Trigger Beneficial Ownership Reviews Cfpb Releases Beta Hmda Platform Nafcu

Community Bankers And The New Cdd Rule Acams Today

Breaking Down Beneficial Ownership Banking Exchange

Bank Secrecy Act Compliance Ppt Download

Beneficial Ownership Rule What Is It And What Does It Mean For Pacs Pac Outsourcing Llc

Federal Register Customer Due Diligence Requirements For Financial Institutions Correction

5 4 6 Treasury S New Ppp Math Is Creating Unnecessary Confusion Here S A Proposed Solution Regtech Consulting Llc

Federal Register Customer Due Diligence Requirements For Financial Institutions Correction

Federal Register Customer Due Diligence Requirements For Financial Institutions

Https Www Clearygottlieb Com Media Organize Archive Cgsh Files Publication Pdfs Alert Memos Alert Memo Updated 2 201651 Pdf

Ultimate Beneficial Ownership Complyadvantage

Why Does My Bank Ask For My Information Richwood Bank

Https Www Paulweiss Com Media 3531330 10may16wc Pdf

Http Www Minnbankers Com Mba Docs Bktbguidetobeneficialownership Pdf

Https Www Aba Com Media Documents Backgrounders Aml Bsa Snapshot Pdf Rev Ce33f9f824c6418283e01426e8a0a0b9

5 4 6 Treasury S New Ppp Math Is Creating Unnecessary Confusion Here S A Proposed Solution Regtech Consulting Llc

Bank Secrecy Act How Beneficial Ownership Rules Affect You Bank Iowa

Post a Comment for "Bank Secrecy Act Beneficial Ownership Rule"