Bank Secrecy Act Sar Filing Requirements

The purpose of this document is to provide the requirements and conditions for electronically filing the Bank Secrecy Act Suspicious Activity Report BSA SAR. Banks may also file SARs on continuing activity earlier than the 120 day deadline if the bank believes the activity warrants earlier review by law enforcement.

(57).jpg)

The Bank Secrecy Act Quiz Trivia Proprofs Quiz

1 Bank Secrecy Act.

Bank secrecy act sar filing requirements. Due to the confidentiality of grand jury proceedings if a bank files a SAR after receiving a grand jury subpoena law enforcement discourages banks from including any reference to the receipt or existence of the grand jury subpoena in the SAR. Exemptions from Bank Secrecy Act Reporting Requirements Only cash transactions with a Federal Reserve Bank are automatically exempt from BSA reporting requirements. Must be kept confidential.

Iii the fact that the filing institution is filing the SAR solely because the subject is engaged in a marijuana-related business. This course describes the Bank Secrecy Act BSA requirements for a bank to file a Suspicious Activity Report SAR and why federal law limits sharing information about SARs. I identifying information of the subject and related parties.

But financial institutions face a dilemma that has not been solved via the courts or academia. Review your credit unions BSA policy and procedures for more information on. The Bank Secrecy Act BSA enacted in 1970 authorizes the Secretary of the Treasury to issue regulations requiring that financial institutions keep records and file reports on certain financial transactions.

The Bank Secrecy Act authorizes the Secretary of the Treasury to require financial institutions to keep records and file reports that have a high degree of usefulness in criminaltax or regulatory investigations or in the conduct of intelligence or counterintelligence activities relating to international terrorismThis has excluded non-bank RMLOs until recently. 5311 et seq is referred to as the Bank Secrecy Act BSA. Requirements for Bank Secrecy Act Suspicious Activity Report BSA SAR to FinCEN Suspicious Activity Report FinCEN SAR Electronic Filing Requirements and replaces BSA SAR with FinCEN SAR through the document.

Despite the Bank Secrecy Act BSA safe harbor provision filing a SAR does not excuse a financial institution from liability for continuing to transact business with a client. And iv the fact that no additional suspicious activity has been identified. A financial institution is required to file a suspicious activity report no later than 30 calendar days after the date of initial detection of facts that may constitute a.

It covers the components of a SAR monitoring and reporting system and how to answer the. The bank should determine whether a SAR should be filed based on all customer information available. Suspicious Activity Reporting SAR Filing Requirements Below are the key Suspicious Activity Reporting SAR filing requirements as stipulated by the Financial Crimes Enforcement Network FinCEN.

The authority of the Secretary to administer Title II of the BSA codified at 31 USC. Electronic filing of this report will be through the BSA E-Filing System operated by the Financial Crimes Enforcement Network FinCEN. O May involve potential money laundering or other illegal activity eg terrorism financing.

And Foreign Transactions Act of 1970 31 USC. If no suspect was identified on the date of detection of the incident requiring the filing a national bank may delay filing a SAR for an additional 30 calendar days to identify a suspect. Suspicious Activity Reports SAR As of April 1 2013 financial institutions must use the Bank Secrecy Act BSA E-Filing System in order to submit Suspicious Activity Reports.

FinCEN is a bureau of the US Department of Treasury that is responsible for managing and enforcing Anti-Money Laundering and Bank Secrecy Act rules and regulations. Board Notification Of SAR Filings. The content of this SAR should be limited to the following information.

Understanding Its Reporting Requirements 2 What to Report under BSA. The institution may in effect be aiding and abetting a criminal if it continues to transact business with an alleged money. 5311-5330 with implementing regulations at 31 CFR Chapter X formerly 31 CFR Part 103 has been.

The Bank Secrecy Act BSA implementing regulations at 31 CFR Chapter X require covered financial institutions to file reports of suspicious transactions with the Department of the Treasurys Financial Crimes Enforcement Network FinCEN in circumstances where the bank knows suspects or has reason to suspect that the transaction involves funds from illegal activities. Updates Part IV TIN Item 80 2A record pos. Subsequent guidance permits banks with SAR requirements to file SARs for continuing activity after a 90 day review with the filing deadline being 120 calendar days after the date of the previously related SAR filing.

It is not intended to does not and may not be relied upon to create any rights. Bank Secrecy Act Including Failures in AML and SAR Filing Programs This article was prepared by the Commodity Futures Trading Commissions Whistleblower Office. Must be reported to the Board or a Board committee Must provide sufficient information.

Ii addresses of the subject and related parties. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a financial institutions customer relationships. For all other transactions that may qualify for exemption a credit union must file a special form to designate the person or organization as exempt.

Mandatory SAR Filings Credit unions are required to file a SAR with respect to. The proposed rule would allow the FDIC in conjunction with the Financial Crimes Enforcement Network FinCEN to grant supervised institutions exemptions to SAR filing requirements when developing innovative solutions to meet Bank Secrecy Act BSA requirements more efficiently and effectively The FDIC would seek FinCENs concurrence with an exemption when the exemption request involves the filing of a SAR. This article is provided for general informational purposes only and does not provide legal or investment advice to any individual or entity.

A national bank is required to file a SAR no later than 30 calendar days after the date of the initial detection of facts that may constitute a basis for filing a SAR. Activity aggregating 5000 or more if the credit union or an affiliate knows suspects or has reason to suspect that the transaction. For more information on the BSA E-Filing System and to register please go.

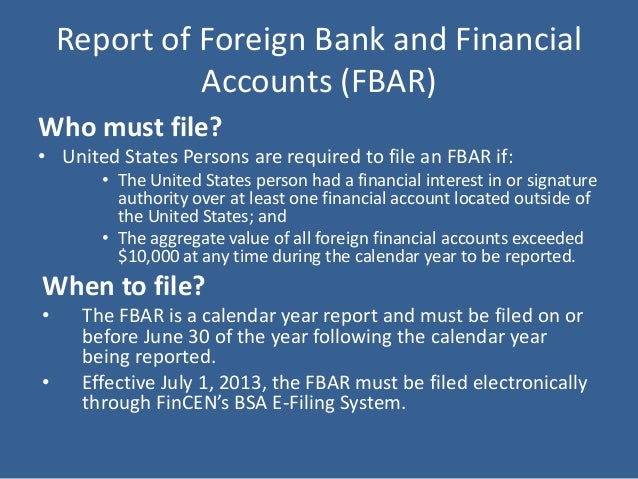

FinCEN Form 104 - Currency Transaction Report CTR FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments CMIR Treasury Department Form 90221 - Report of Foreign Bank and Financial Accounts FBAR Suspicious Activity Report SAR 3.

Guide Fincen S Suspicious Activity Report Sar For Vasps Sygna

Bank Secrecy Act Understanding Its Reporting Requirements

Bank Secrecy Act Anti Money Laundering Examination Manual Ffiec

Bank Secrecy Act Understanding Its Reporting Requirements

Bank Secrecy Act And Anti Money Laundering Service Lexisnexis Store

Bank Secrecy Act Suspicious Activity Report Use Is Increasing But Fincen Needs To Further Develop And Document Its Form Revision Process Unt Digital Library

4 26 14 Disclosure Internal Revenue Service

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act Suspicious Activity Report Use Is Increasing But Fincen Needs To Further Develop And Document Its Form Revision Process Unt Digital Library

Bank Secrecy Act Suspicious Activity Report Use Is Increasing But Fincen Needs To Further Develop And Document Its Form Revision Process Unt Digital Library

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Bank Secrecy Act Reporting Expectations Ctrs And Sars Arc Risk And Compliance

Suspicious Activity Reporting The Prosecutor S Perspective Ppt Download

10 Fast Facts About The Bank Secrecy Act

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Subject Suspicious Activity Report Filing Requirements For Ffiec

Post a Comment for "Bank Secrecy Act Sar Filing Requirements"