Violation Bank Secrecy Act Regulations

Small banks other financial institutions need to recognize obligations under Bank Secrecy Act On October 27 2017 the US. The penalty amount could not exceed 500.

Bsa Aml Compliance What Is The Bank Secrecy Act

31 CFR Chapter X Effective March 1 2011 The Federal Register contains final regulations issued after the date of codification as well as the Notices of Proposed Rulemaking.

Violation bank secrecy act regulations. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. Law requiring financial institutions in the United States to assist US. Violations of the Bank Secrecy Act Can Be The Basis of Large Bounty Actions.

The penalty amount could not exceed 500. If the individual commits a willful BSA violation while breaking another law or committing other criminal activity he or she is subject to a fine of up to 500000 or ten years in prison or both. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA.

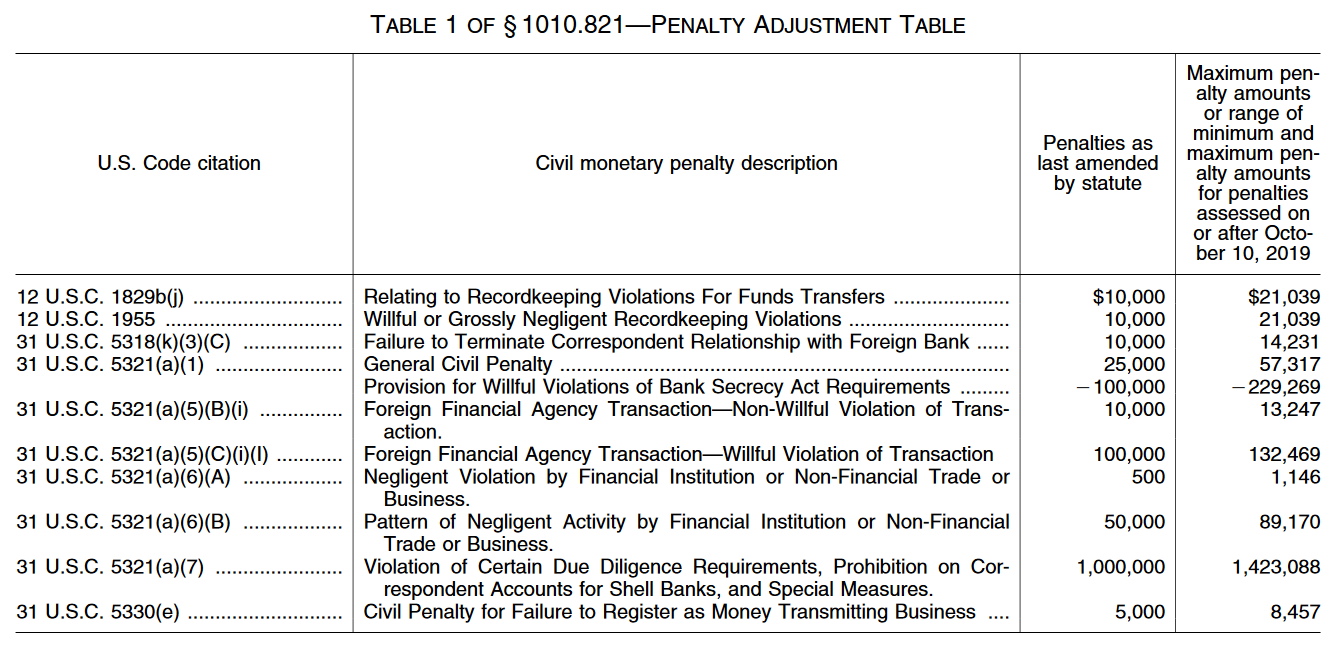

This section ensures that national banks file a Suspicious Activity Report when they detect a known or suspected violation of Federal law or a suspicious transaction related to a money laundering activity or a violation of the Bank Secrecy Act. These regulations inaddition to other applicable legal require-ments are summarized as. A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation.

More specifically the Act requires FCMs and IBs to maintain and implement a written anti-money laundering AML policy. Government agencies in detecting and preventing money laundering. This regulation requires every national bank to file a Suspicious Activity Report SAR when they detect certain known or suspected violations of federal law or suspicious transactions related to a money laundering activity or a violation of the BSA.

Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. In the philippines republic act no. A federal law the Bank Secrecy Act BSA mandates that financial institutions must collect and retain information about their customers and their identities and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of Treasury.

BSA-Related Violations For state-chartered nonmember bankssupervised by the FDIC applicable BSA-related violations include infractions ofFDIC Rules and Regulations 12 CFR3268 and 12 CFR 353 as well as theDepartment of Treasury Regulations 31 CFR 103. Which of the following is responsible for administration of the Bank Secrecy Act. What is the fine for violating bank secrecy act.

Title 31 revisions include new BSA violations and penalties regarding incomplete or false reports and transactions that involve entities labeled as primary money laundering concerns. Violation of bank secrecy transcript. By Aaron Nicodemus 2020-08-14T18000001.

6426 an act instituting a foreign currency deposit system in the philippines and for other purposes. Section 5311 et seq requires financial institutions to maintain appropriate records and to file certain reports that are used in criminal tax or regulatory investigations or proceedings. 5321 a 1 were last adjusted by statute in 1986.

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Negligence is further discussed in IRM 426741. Violations of certain BSA provisions or special measures can make an institution subject to a criminal money penalty up to the greater of 1million or twice the value of the transaction.

Two federal agencies that oversee Bank Secrecy Act requirements have notified financial institutions they will agree to reasonable delays in the filing of required reports if institutions can show the delays. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. What is the fine for violating Bank Secrecy Act regulations.

Federal banking regulators clarify BSAAML compliance violation response. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. The Bank Secrecy Act requires Futures Commission Merchants FCMs and Introducing Brokers IBs to comply with several laws.

Its a course of by which soiled cash is converted into clean cash. 5311 et seq is referred to as the Bank Secrecy Act BSA. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. What is the fine for violating Bank Secrecy Act regulations. The Bank Secrecy Act of 1970 Public Law 91-508 codified to 31 USC.

Congress enacted the BSA to prevent. 5321 a 1 relating to willful violations of Bank Secrecy Act requirements. Codified Bank Secrecy Act BSA Regulations.

A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation. Violation Bank Secrecy Act Regulations Fine Up To. The purpose of the BSA is to require United States US.

Regulatory supervision of reporting companies is expected to intensify with the Anti-Money Laundering Act of 2020 AMLA amendment of Title 31 of the Bank Secrecy Act BSA.

Fincen Issues First Ever Civil Penalty Against Bitcoin Exchange Https Bitcoinmagazine Com Articles Fincen I Bank Secrecy Act Us Department Of Justice Bitcoin

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

![]()

The Secret History Of The Bank Secrecy Act Fti Consulting

Https Www Fdic Gov Regulations Resources Director Virtual Bsa Pdf

Bank Secrecy Act Bsa Aml U S Laws And Regulations

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

What Are The Anti Money Laundering Laws Nacho Money

Bank Secrecy Act Compliance Ppt Download

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Http Www Yorkcast Com Nafcu Handouts 2016 02 03 Presentation Pdf

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Lawmakers Banking Trade Transparency Groups Push For Sweeping Aml Bill To Be Included In Ndaa Cfcs Association Of Certified Financial Crime Specialists

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bsa Violation Civil Penalties Increase Nafcu

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Post a Comment for "Violation Bank Secrecy Act Regulations"