Violation Bank Secrecy Act Regulations Fine Up To

More specifically targeted violations include improper supervision and records violations. Department of Justice issued a 185 million civil money penalty against US.

Bsa New Aml 2020 Compliance Alert

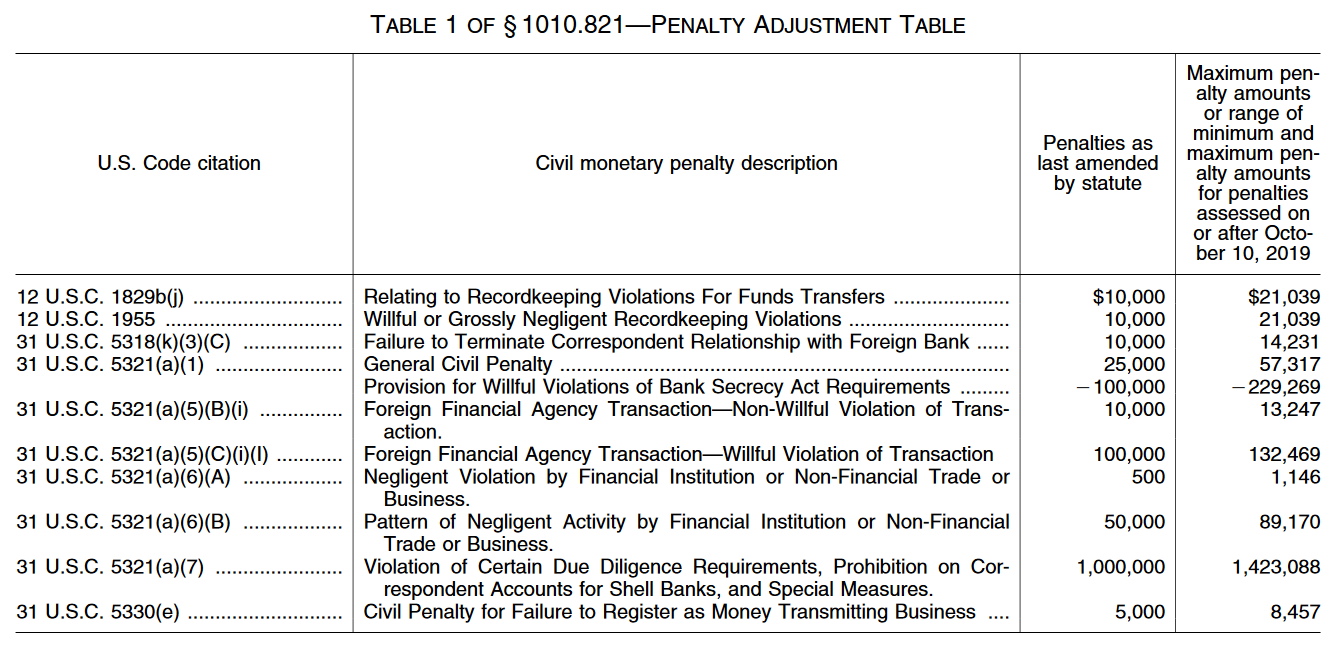

Violations of certain due diligence requirements can result in penalties all the way up to 1424088.

Violation bank secrecy act regulations fine up to. Equal Credit Opportunity Act Regulation B. What is the fine for violating Bank Secrecy Act regulations. New York-based Apple Bank agreed to pay 125 million to settle a Federal Deposit Insurance Corp.

The purpose of the BSA is to require United States US. In numerous cases banks made a practice of requiring spousal signatures on commercial loan applications because of a blanket. Which of the following is responsible for administration of the Bank Secrecy Act.

The FDIC order to pay against the New York-based financial institution issued Dec. Branch Commerzbank AG New York Branch Commerz New York have agreed to forfeit 563 million pay a 79 million fine and enter into a deferred prosecution agreement with the Justice Department for violations of the International Emergency Economic Powers Act IEEPA and the Bank Secrecy Act. What is the fine for violating Bank Secrecy Act regulations.

What is the fine for violating bank secrecy act. Even violations related to funds transfer recordkeeping result in penalties of up to 21039. If the person commits a BSA violation in conjunction with violating other US.

FDIC claim that it violated the Bank Secrecy Act between April 2014 and September 2018 The Wall Street Journal reported according to an order issued in. According to the order Apple Bank. Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269.

The penalty amount could not exceed 500. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. The penalty amount could not exceed 500.

5321 a 1 were last adjusted by statute in 1986. The general rule is that a bank cannot require the signature of a spouse on an individual application if the applicant is creditworthy on their own. Commerzbank AG a global financial institution headquartered in Frankfurt Germany and its US.

The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. In addition banks risk losing their charters and bank employees risk being removed and barred from banking Criminal penalties can be assessed for willful BSA regulation violations. In February 2018 FinCEN in coordination with the Office of the Comptroller of the Currency OCC and the US.

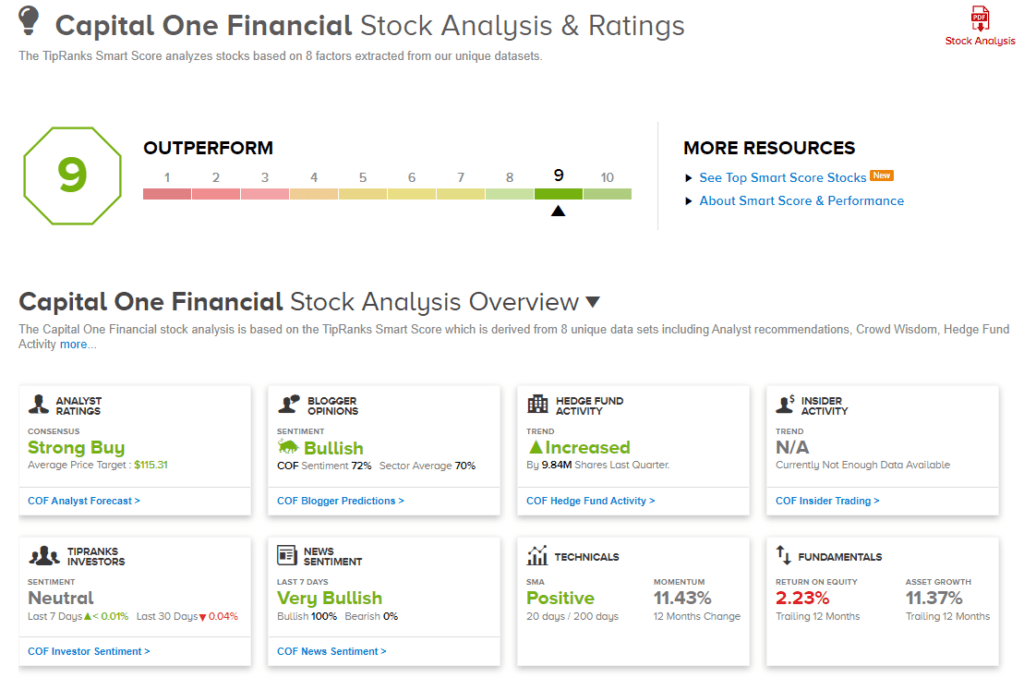

WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. 5311 et seq is referred to as the Bank Secrecy Act BSA. Bank for among other things willfully violating the BSAs requirements to implement and maintain an effective anti-money laundering AML program and to file Suspicious Activity Reports SARs in a timely manner.

The penalty amount could not exceed 500. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Any individual including a credit union employee found guilty of this is subject to criminal fines of up to 250000 or five years in prison or both.

A SAR filing is required for any potential crimes. Laws or participating in other criminal activity that individual is subject to a fine of up to 500000 or ten years in prison or both. The Federal Deposit Insurance Corporation FDIC has fined Apple Bank for Savings 125 million for violations of the Bank Secrecy Act BSA related to anti-money laundering controls.

Specific Bank Secrecy Act Violations. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. New York Bank Fined For Anti-Money-Laundering Law Failures Apple Bank for Savings will pay the FDIC 125 million for allegedly failing to comply with the Bank Secrecy Act.

This regulation requires every national bank to file a Suspicious Activity Report SAR when they detect certain known or suspected violations of federal law or suspicious transactions related to a money laundering activity or a violation of the BSA. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. Increased the civil and criminal penal-ties for money laundering.

5321 a 1 relating to willful violations of Bank Secrecy Act requirements. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for recordkeeping violations. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

The Patriot Act and its implementing regulations also Expanded the AML program require-ments to all financial institutions. Provided the Secretary of the Trea-sury with the authority to impose 22 T he Bank Secrecy Act BSA and its implementing rules are not new. Likewise what is the Bank Secrecy Act policy.

The agency also wants help. They also want violations related to failures to diligently supervise officers employees and agents opening and handling of accounts. 21 2020 was made public Jan.

The CFTC is seeking Bounty Actions involving several specific schemes and violations. Spousal signatures required in contravention of the regulatory requirements.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act Bsa Aml U S Laws And Regulations

Bsa Aml Violations Can Cost You Nafcu

Bank Secrecy Act Internal Controls Fraud Ppt Download

Http Www Yorkcast Com Nafcu Handouts 2016 02 03 Presentation Pdf

Bank Secrecy Act Antimoney Laundering And Ofac Compliance

Bsa Aml Compliance What Is The Bank Secrecy Act

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bsa Violation Civil Penalties Increase Nafcu

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

![]()

The Secret History Of The Bank Secrecy Act Fti Consulting

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act Antimoney Laundering And Ofac Compliance

Lawmakers Banking Trade Transparency Groups Push For Sweeping Aml Bill To Be Included In Ndaa Cfcs Association Of Certified Financial Crime Specialists

Bank Secrecy Act Antimoney Laundering And Ofac Compliance

Capital One Fined 390m For Violating Bank Secrecy Act Nasdaq

Post a Comment for "Violation Bank Secrecy Act Regulations Fine Up To"