What Is The Fine For Violating The Bank Secrecy Act

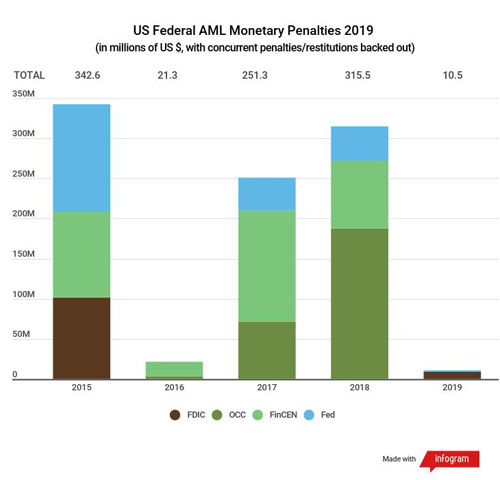

An American bank Capital One has been fined 390 million by Financial Crimes Enforcement Network FinCEN for purposely violating the Bank Secrecy Act. What is the fine for violating Bank Secrecy Act regulations.

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

The Secretary of the Treasury is authorized by 31 USC 5321 a 4 Structured Transaction Violation to impose a civil money penalty on any person who structures or attempts to structure a transaction with the intent to evade a Bank Secrecy Act BSA requirement.

What is the fine for violating the bank secrecy act. Bank secrecy act regulations. 1405 otherwise known as the Bank Secrecy Law was approved on September 9 1955. Procedures for Monitoring BSA Compliance - 12 CFR 2121.

FinCEN imposes 2 million penalty against community bank. Similarly what are the penalties for violating the Bank Secrecy Act. Prohibiting financial institu-tions from engaging in business with foreign shell banks.

It is a process by which dirty money is converted into clean money. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. Banks and other financial institutions must ensure they meet the compliance obligations it involves.

Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone. Structuring and Related Prohibited Actions. It was created to encourage people to deposit their money in banking institutions and for the same to be utilized by the banks for the economic development of the country Section 1.

Financial Record Keeping and Reporting of Currency and Foreign Transactions - 31 CFR 1010310. The sources of the cash in actual are prison and the cash is invested in a way that makes it appear like clear cash and hide the id of the criminal a part of the cash earned. What is the fine for violating Bank Secrecy Act regulations.

Under the Bank Secrecy Act BSA and related anti-money laundering laws banks must. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. 5321 a 1 relating to willful violations of Bank Secrecy Act requirements.

Requiring financial institutions to have due diligence proce-dures and in some cases enhanced due. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

Small banks other financial institutions need to recognize obligations under Bank Secrecy Act. On October 27 2017 the US. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

What is the fine for violating Bank Secrecy Act regulations. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Which of the following is responsible for administration of the Bank Secrecy Act. It is a process by which soiled money is transformed into clean money. Bank was fined 185 million by FinCEN the OCC and the DOJ for violating the Bank Secrecy Act.

Part 3268b1 of. Bank failed to conduct appropriate due diligence related to Mexican customer. Of the Patriot Act in October 20013 The Patriot Act criminalized the financing of terrorism and augmented the BSA by strengthening customer identification procedures.

Bank Secrecy Act Regulations August 11 2021 The concept of cash laundering is essential to be understood for those working in the monetary sector. The sources of the money in actual are criminal and the money is invested in a approach that makes it appear like clean cash and hide the identity of. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

January 15 2021. The sources of the cash in actual are prison and the money is invested in a way that makes it appear to be clean money and hide the id of the prison a part of the money earned. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Foreign Assets Control Regulations OFAC 31 CFR 500. Its a course of by which soiled cash is converted into clean cash. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

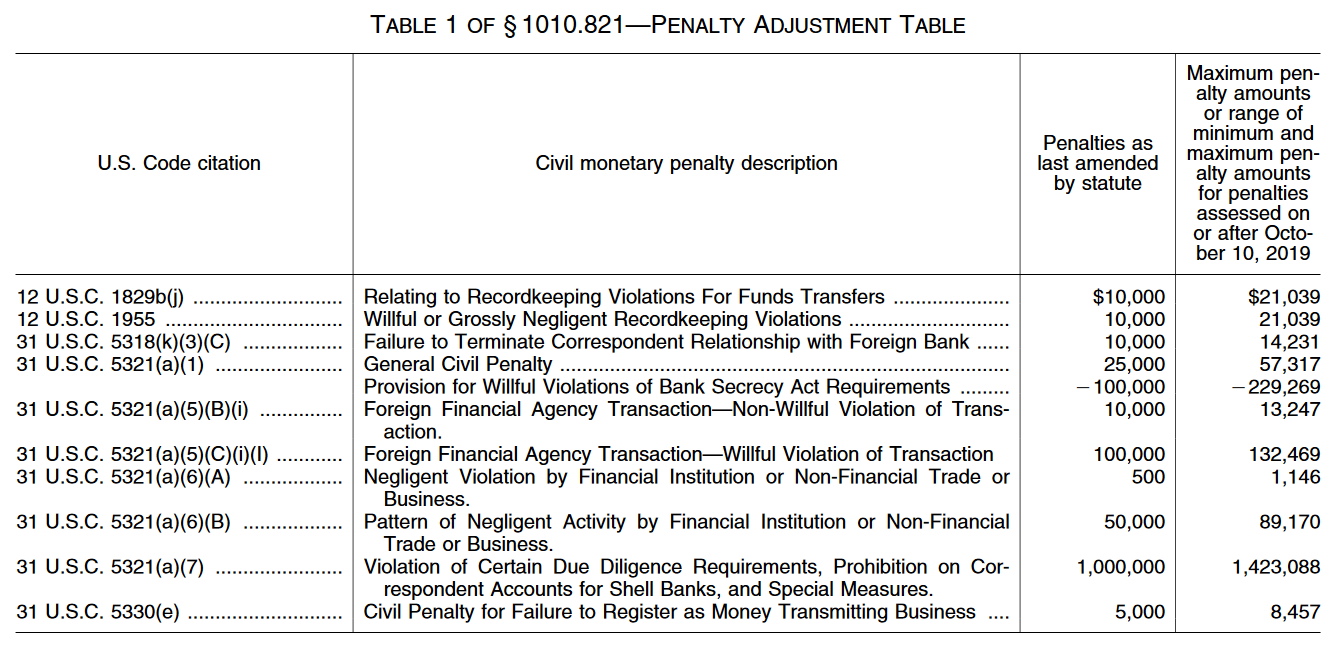

Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for recordkeeping violations for funds. What is the fine for violating bank secrecy act. This regulation requires every national bank and savings association to have a written board approved program that is reasonably.

Bank Secrecy Act - 31 USC 5311 - 5330. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. 5321 a 1 were last adjusted by statute in 1986.

Bank Secrecy Act Penalties August 10 2021 The idea of money laundering is essential to be understood for these working in the financial sector. Violation Bank Secrecy Act Regulations Fine Up To. Bank regulation news.

WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations.

Bsa Aml Compliance What Is The Bank Secrecy Act

Bsa Violation Civil Penalties Increase Nafcu

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Bank Secrecy Act Bsa Aml U S Laws And Regulations

Bsa Violation Civil Penalties Increase Nafcu

Bsa Aml Violations Can Cost You Nafcu

Https Www Fdic Gov Foia Files Instructionsandmatrixforbanksecrecyact Pdf

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Ex Us Bank Risk Officer Fined Over Aml Compliance Pymnts Com

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

U S Treasury Report Irs Bsa Program Has Minimal Impact On Compliance Ballard Spahr Llp Jdsupra

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Moneylaundering Com Changes In Bank Regulations Financial Compliance Regulations Regulation Banks Money Laundering Cases Anti Money Laundering Money Laundering Training

Board Member Responsibilities For Bsa Aml Compliance Troutman Pepper

Bsa Aml Violations Can Cost You Nafcu

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

1970 To 2021 The Us Anti Money Laundering Act History Complyadvantage

Lawmakers Banking Trade Transparency Groups Push For Sweeping Aml Bill To Be Included In Ndaa Cfcs Association Of Certified Financial Crime Specialists

Post a Comment for "What Is The Fine For Violating The Bank Secrecy Act"